Strong post-pandemic demand in the PRC and new clinic expansion bolster organic growth, upgrade the rating to “Buy” and adjust the TP upward to HKD 6.71/share

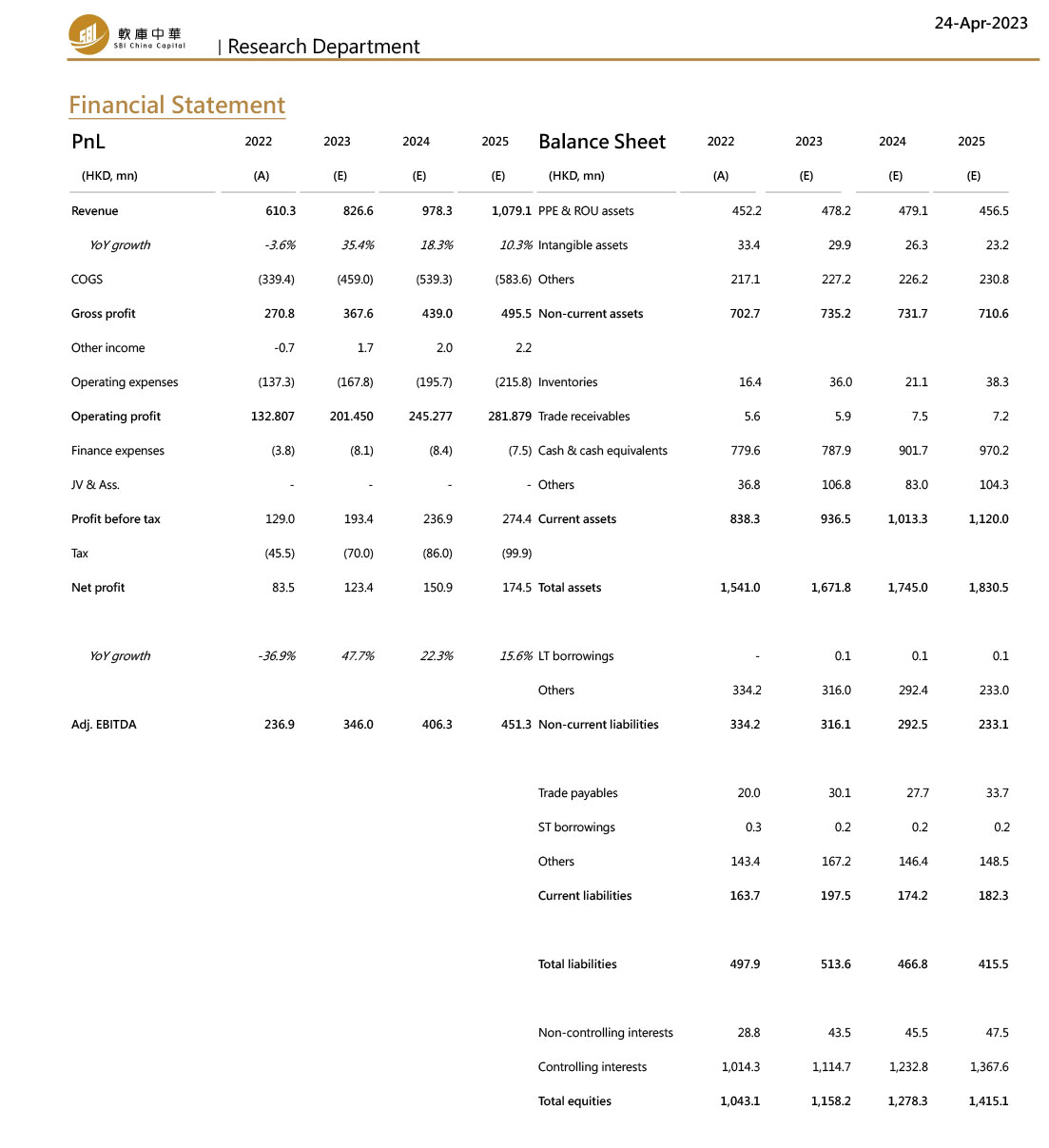

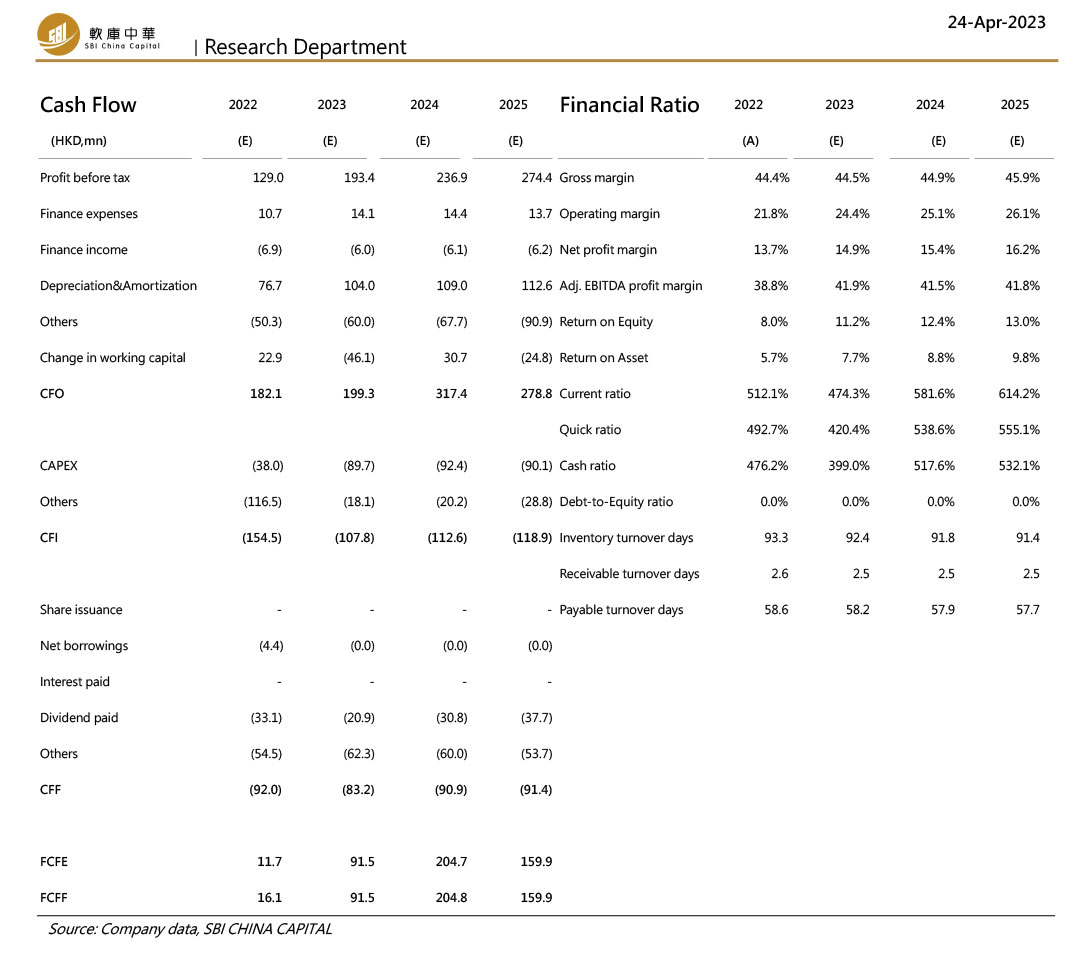

EuroEyes(01846.HK) announced its annual result, with a turnover of HKD 610.3 mn in 2022, implying a 3.6% YoY decline. The adjusted gross profit margin(excluding share-based compensation expenses for surgeons and clinic pre-operating expenses) decreased by 5.0p.p YoY to 45.2%. The adjusted net profit of the Group fell 26.3% YoY to approximately 101.2mn in 2022, representing a 5.1p.p YoY drop in adjusted net profit margin to 16.6%.

Despite the sales in 2022 being slightly below our previous forecast, the overall performance of Euroeyes(01846.HK) maintained a stable financial condition amidst the highly unstable global economic situation in 2022 and steadily expanded its eye clinics. The Group experienced a decline in capacity utilization rate from 26.2% to 22.8%, primarily due to i.) a two- month lockdown in Shanghai and the closure of Beijing, ii.) COVID-19 control policies in Denmark resulting in a 60-day gap in surgery operations, iii.) the lifting of pandemic-related travel restrictions across Europe, which shifted consumer interests towards vacation travel and delayed patients' operation schedules. As a result, the Group recorded a roughly equivalent decline in both adjusted gross and net profit margin.

Strong demand for eye surgery in China post-pandemic recovery fueled rally in 1Q23 sales

The Group's business in Shanghai and Beijing was disrupted for two months due to citywide lockdown and strict control measures, respectively. In addition, the spike of COVID-19 cases in the 4Q22 hampered normal social activities in the PRC, leading to a temporary shortfall in outpatient consultations and surgery reservations.

However, since the PRC government's removal of its zero-Covid policy, there has been a strong rebound in the eye surgery market, stimulating the Group's quarterly sales of vision correction services in the PRC to return to pre-pandemic levels in 1Q23.

The Group is establishing consultation centers as satellite clinics in Beijing and Shanghai to redirect patients to its surgical clinics, thereby optimizing clinical resources and further increasing utilization rates. We anticipate the Group's sales in the PRC to recover to 2021 levels this year.

The expansion of new clinics propels its organic growth sustainably

The Group plans to launch five new clinics, including three in Germany (Baden-Baden, Wiesbaden, and Kiel), one in London(Knightsbridge), and one in Hong Kong(Russell Street), which are expected to generate extra sales revenue in 2H23. In addition, we expect the flagship clinic in Paris will begin its operations in 1H24.

Notably, the Group made strategic moves to expand its refractive surgery market in the UK with the acquisition of the London Vision Clinic in Jan 2022 and the recruitment of Professor Reinsteink. In line with this, the Group plans to launch a new clinic in Knightsbridge in 2Q23, with Dr. Fadi Kherdaji, a renowned specialist in refractive surgery, leading the local market development. However, among the six new clinics, we forecast the ones in Hong Kong and Paris may require a longer payback period due to higher rental costs.

Strong post-pandemic demand in the PRC and new clinic expansion bolster organic growth, upgrade the rating to “Buy” and adjust the TP upward to HKD 6.71/share

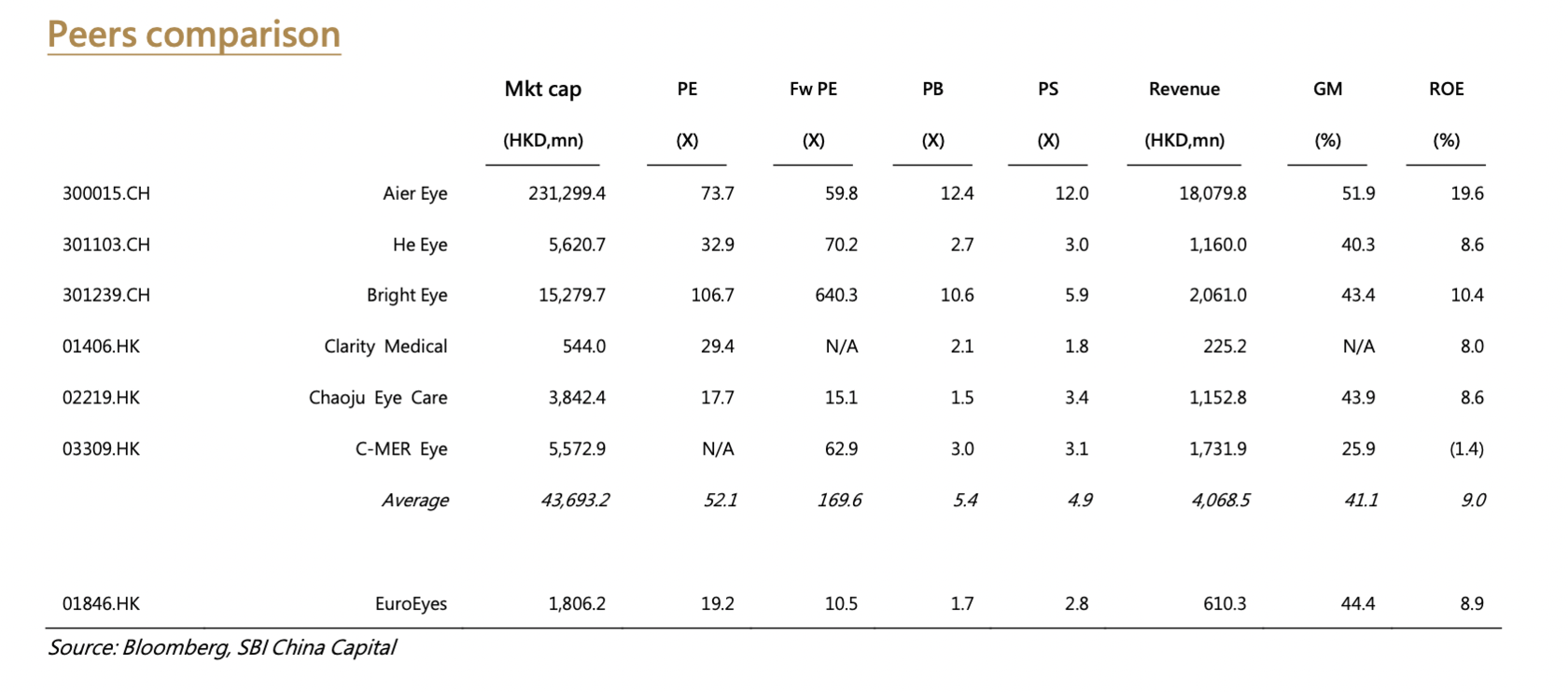

The overall performance of the Group in 2022 aligned with our expectation. Following the PRC government’s decision to lift its zero- Covid policy at the end of 2022, we have seen a strong rebound in the eye surgery market, and we believe that the Group's business in China will experience a full recovery and resurgence in 2023. Furthermore, the Group's expansion plans, including the addition of five clinics(three in Germany, one in London, and one in Hong Kong) and the flagship clinic in Paris set to launch in 2H23 and 1H24 respectively, are expected to sustainably contribute extra sales and bolster its organic growth. Moreover, due to the company's strong operating cash inflow and sufficient cash position, we do not rule out the possibility of potential M&A activities that may further steepen the Group's growth trajectory. Therefore, we upgrade the rating to “Buy” and adjust the TP upward to HKD 6.71/share, implying 18.1x/14.8x/12.8x fw PE of 2023/2024/2025.

EuroEyes(01846.HK) announced its annual result, with a turnover of HKD 610.3 mn in 2022, implying a 3.6% YoY decline. The adjusted gross profit margin(excluding share-based compensation expenses for surgeons and clinic pre-operating expenses) decreased by 5.0p.p YoY to 45.2%. The adjusted net profit of the Group fell 26.3% YoY to approximately 101.2mn in 2022, representing a 5.1p.p YoY drop in adjusted net profit margin to 16.6%.

Despite the sales in 2022 being slightly below our previous forecast, the overall performance of Euroeyes(01846.HK) maintained a stable financial condition amidst the highly unstable global economic situation in 2022 and steadily expanded its eye clinics. The Group experienced a decline in capacity utilization rate from 26.2% to 22.8%, primarily due to i.) a two- month lockdown in Shanghai and the closure of Beijing, ii.) COVID-19 control policies in Denmark resulting in a 60-day gap in surgery operations, iii.) the lifting of pandemic-related travel restrictions across Europe, which shifted consumer interests towards vacation travel and delayed patients' operation schedules. As a result, the Group recorded a roughly equivalent decline in both adjusted gross and net profit margin.

Strong demand for eye surgery in China post-pandemic recovery fueled rally in 1Q23 sales

The Group's business in Shanghai and Beijing was disrupted for two months due to citywide lockdown and strict control measures, respectively. In addition, the spike of COVID-19 cases in the 4Q22 hampered normal social activities in the PRC, leading to a temporary shortfall in outpatient consultations and surgery reservations.

However, since the PRC government's removal of its zero-Covid policy, there has been a strong rebound in the eye surgery market, stimulating the Group's quarterly sales of vision correction services in the PRC to return to pre-pandemic levels in 1Q23.

The Group is establishing consultation centers as satellite clinics in Beijing and Shanghai to redirect patients to its surgical clinics, thereby optimizing clinical resources and further increasing utilization rates. We anticipate the Group's sales in the PRC to recover to 2021 levels this year.

The expansion of new clinics propels its organic growth sustainably

The Group plans to launch five new clinics, including three in Germany (Baden-Baden, Wiesbaden, and Kiel), one in London(Knightsbridge), and one in Hong Kong(Russell Street), which are expected to generate extra sales revenue in 2H23. In addition, we expect the flagship clinic in Paris will begin its operations in 1H24.

Notably, the Group made strategic moves to expand its refractive surgery market in the UK with the acquisition of the London Vision Clinic in Jan 2022 and the recruitment of Professor Reinsteink. In line with this, the Group plans to launch a new clinic in Knightsbridge in 2Q23, with Dr. Fadi Kherdaji, a renowned specialist in refractive surgery, leading the local market development. However, among the six new clinics, we forecast the ones in Hong Kong and Paris may require a longer payback period due to higher rental costs.

Strong post-pandemic demand in the PRC and new clinic expansion bolster organic growth, upgrade the rating to “Buy” and adjust the TP upward to HKD 6.71/share

The overall performance of the Group in 2022 aligned with our expectation. Following the PRC government’s decision to lift its zero- Covid policy at the end of 2022, we have seen a strong rebound in the eye surgery market, and we believe that the Group's business in China will experience a full recovery and resurgence in 2023. Furthermore, the Group's expansion plans, including the addition of five clinics(three in Germany, one in London, and one in Hong Kong) and the flagship clinic in Paris set to launch in 2H23 and 1H24 respectively, are expected to sustainably contribute extra sales and bolster its organic growth. Moreover, due to the company's strong operating cash inflow and sufficient cash position, we do not rule out the possibility of potential M&A activities that may further steepen the Group's growth trajectory. Therefore, we upgrade the rating to “Buy” and adjust the TP upward to HKD 6.71/share, implying 18.1x/14.8x/12.8x fw PE of 2023/2024/2025.

Risk factors

- Malpractice and medical negligence

- Inability to provide services with the latest technology

- Potential economic recession

- The lower than expected rebound of surgery demand in the PRC and Europe

- Operating expenses escalate rapidly due to out-of-control inflation

- London Vision fails to achieve the growth target

BI China Capital is a dedicated small/mid cap investment banking/ stockbrokerage house. Find our research on: research@sbichinacapital.com, thomsononeanalytics.com, factset.com, S&P Capital IQ and multex.com.

SBI China Capital Financial Services Ltd. acted as the sub-underwriter for EuroEyes International Eye Clinic Limited (Stock code: 01846.HK) in Oct 2019.

Analyst certification: The views expressed in this report accurately reflect the analyst’s personal views of the subject securities and that the analyst has not received and will not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this report.

Disclaimer:

This research report is not an offer to sell or the solicitation of an offer to buy or subscribe for any securities. The securities referred to in this report may not be eligible for sale in some jurisdictions. The information contained in this report has been compiled by the Research Department of SBI China Capital Financial Services Limited (‘SBI China Capital’) from sources that it believes to be reliable but no representation, warranty or guarantee is made or given by SBI China Capital or any other person as to its accuracy or completeness. All opinions and estimates expressed in this report are (unless otherwise indicated) entirely those of SBI China Capital as of the date of this report only and are subject to change without notice. Neither SBI China Capital nor any other person, accepts any liability whatsoever for any loss howsoever arising from any use of this report or its contents or otherwise arising in connection therewith. Each recipient of this report shall be solely responsible for making its own independent investigation of the business, financial condition and prospects of the companies referred to in this report. SBI China Capital and their respective officers, directors and employees, including persons involved in the preparation or issuance of this report, may from time to time (1) have positions in, and buy or sell, the securities of companies referred to in this report (or related investments); (2) have a consulting, investment banking or broking relationship with any company referred to in this report; and (3) to the extent permitted under applicable law, have acted upon or used the information contained or referred to in this report including effecting transactions for their own account in an investment (or related investment) in respect of any company referred to in this report, prior to or immediately following its publication. This report may not have been distributed to all recipients at the same time. This report is issued only for the information of and may only be distributed to professional investors and dealers in securities and must not be copied, published, reproduced or redistributed (in whole or in part) by any recipient for any purpose. This report is distributed in Hong Kong by SBI China Capital. Any recipient of this report who requires further information regarding any securities referred to in this report should contact the relevant office of SBI China Capital located in such recipient’s home jurisdiction.

Copyright© SBI China Capital Financial Services Limited. All rights reserved.

Analyst certification: The views expressed in this report accurately reflect the analyst’s personal views of the subject securities and that the analyst has not received and will not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this report.

Disclaimer:

This research report is not an offer to sell or the solicitation of an offer to buy or subscribe for any securities. The securities referred to in this report may not be eligible for sale in some jurisdictions. The information contained in this report has been compiled by the Research Department of SBI China Capital Financial Services Limited (‘SBI China Capital’) from sources that it believes to be reliable but no representation, warranty or guarantee is made or given by SBI China Capital or any other person as to its accuracy or completeness. All opinions and estimates expressed in this report are (unless otherwise indicated) entirely those of SBI China Capital as of the date of this report only and are subject to change without notice. Neither SBI China Capital nor any other person, accepts any liability whatsoever for any loss howsoever arising from any use of this report or its contents or otherwise arising in connection therewith. Each recipient of this report shall be solely responsible for making its own independent investigation of the business, financial condition and prospects of the companies referred to in this report. SBI China Capital and their respective officers, directors and employees, including persons involved in the preparation or issuance of this report, may from time to time (1) have positions in, and buy or sell, the securities of companies referred to in this report (or related investments); (2) have a consulting, investment banking or broking relationship with any company referred to in this report; and (3) to the extent permitted under applicable law, have acted upon or used the information contained or referred to in this report including effecting transactions for their own account in an investment (or related investment) in respect of any company referred to in this report, prior to or immediately following its publication. This report may not have been distributed to all recipients at the same time. This report is issued only for the information of and may only be distributed to professional investors and dealers in securities and must not be copied, published, reproduced or redistributed (in whole or in part) by any recipient for any purpose. This report is distributed in Hong Kong by SBI China Capital. Any recipient of this report who requires further information regarding any securities referred to in this report should contact the relevant office of SBI China Capital located in such recipient’s home jurisdiction.

Copyright© SBI China Capital Financial Services Limited. All rights reserved.

Equity Research Department

T: +852 2533 3700

E: research@sbichinacapital.com

Address: 4/F, Henley Building, No.5 Queen's Road Central, Hong Kong

T: +852 2533 3700

E: research@sbichinacapital.com

Address: 4/F, Henley Building, No.5 Queen's Road Central, Hong Kong